When it comes to volatility, perhaps no sector has suffered so much as natural gas.

Let’s face it, folks: Natural gas prices have been abysmal.

There’s a very good reason why.

To better understand why natural gas at the Henry Hub is trading around $2.35 per MMBtu today, you first have to understand where we were more than 10 years ago — before plays like the Marcellus Shale transformed the United States into an absolute global energy powerhouse.

In 2007, the United States was in deep trouble.

Before companies had started utilizing horizontal drilling with hydraulic fracturing to tap into our wealth of tight gas resources, production had been practically flat for nearly 20 years.

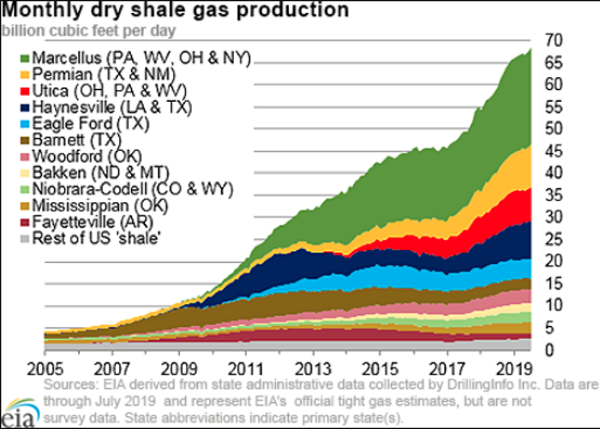

At its core, the issue in the natural gas market over the last decade has been the incredible growth as shale gas production grew at an astronomical growth rate.

Virtually ALL of that growth was due to the Marcellus.

In fact, that one shale gas region accounts for roughly 70% of U.S. dry shale production.

If you haven’t seen this kind of impressive growth yet, let me show you what a true boom looks like:

But the shale boom wasn’t without consequences…

The flood of natural gas that came online drove prices into the gutter.

Right now, prices are trading at a three-year low.

There’s no question that it was one of the most volatile sectors for investors to navigate.

Now, this volatile market is home to one of the safest investments on the market.

To Asia, and Beyond!

“What changed?” you ask.

Well, it all started in August of 2010.

That was when Cheniere submitted its application to build the Sabine Pass terminal and became the focal point for U.S. LNG exports.

At the time, there weren’t any doubts where these LNG exports were headed: Asia.

Long thought of as the primary driver for LNG demand growth, countries like China, Japan, South Korea, and India seemingly couldn’t get enough of it.

Only a handful of LNG buyers make up half of the global market.

Some analysts expect their demand to jump four-fold over the next decade.

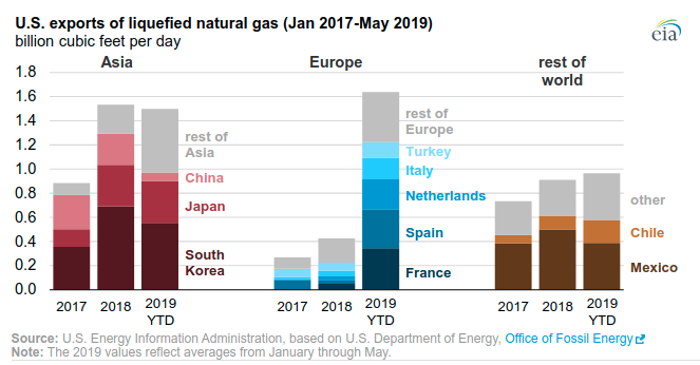

Thing is, it turns out it’s not just Asia that is developing a taste for U.S. LNG.

Over the last year, Europe has been importing more and more of it.

As you can see below, we’re now shipping more LNG to Europe than Asia:

If I had told you in 2007 that the U.S. would become a top exporter of natural gas, you would’ve laughed me out of the room.

Now, the fight for first place has begun.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

An Investment Safe Haven

Reuters recently reported that the United States is now the third-largest LNG exporter on the planet, just behind Qatar and Australia.

U.S. LNG accounts for approximately 10% of the global market.

But things are only just starting to heat up.

So far, the clear winner in this export boom has been Cheniere’s Sabine Pass.

And investors in it for the long term are being rewarded handsomely. Cheniere Energy Partners (NYSE: CQP), which owns and operates the regasification facilities at Sabine Pass, is currently shelling out an annual yield of more than 5.5% at the moment.

Cheniere was first, but it won’t be alone much longer.

On July 31st, the Department of Energy announced that it had approved Gulf LNG Liquefaction Company for exporting domestically produced liquefied natural gas.

Gulf LNG’s project will be constructed in Jackson County, Mississippi.

As it stands now, there’s a record amount of natural being delivered to current U.S. LNG export facilities. In July, these LNG facilities bought a record of 6 billion cubic feet per day of natural gas — that’s around 7% of our total dry gas production!

Is it only a matter of time before the U.S. is on top of the LNG market?

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.